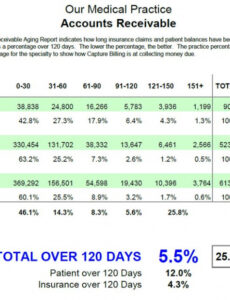

They provide priceless insights into your present money move and anticipated incoming payments. This data is essential for making knowledgeable business decisions, from planning bills and investments to securing financing. By understanding your future money position, you probably can keep away from potential shortfalls and ensure you’ve the resources to satisfy your obligations.

Finance groups can use them to compare what’s coming out and in so as to make better-informed financial selections. The report can also highlight which suppliers you should talk with often or the place it might make sense to renegotiate cost terms. Checking these patterns usually means you possibly can fix small problems earlier than they turn into bigger issues. Assessing the vendors to whom the invoices are owed and pending is important. Make an unbiased determination to determine if the seller fits your small business. The Accounts Payable Growing Older Report provides a quantity of vital advantages, making it a significant software for businesses’ financial administration.

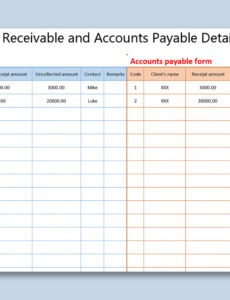

Calculate The Whole Quantities Owed (if You’re Manually Creating The Report)

In this section, we will explain the recording of AP journal entry in your accounting books. Every Time a company has bought any goods or companies from vendors on credit score, they need to record AP journal entry of their accounting books. By leveraging Aging Schedules and other financial instruments, we empower businesses to make informed credit score and collection selections. Invoices with early payment low cost opportunities are flagged, permitting businesses to prioritize funds that provide monetary savings.

By strategically managing AP, corporations can optimize their working capital and maintain a wholesome balance between their outgoing money flows and incoming revenues. This entails not only timely payments to keep away from penalties but also benefiting from credit score terms to enhance cash flow. On the opposite hand, the getting older schedule for accounts payable provides insights into how well an organization is managing its money owed. It can help an organization avoid late cost fees and keep good relationships with suppliers by guaranteeing that payments are made inside the agreed phrases. For occasion, a company might negotiate longer fee phrases with suppliers if it finds that most of its payables are in the 30-day column, indicating a possible money flow issue. The Growing Older Schedule helps companies understand their cash flow and prioritize assortment efforts.

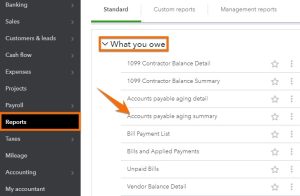

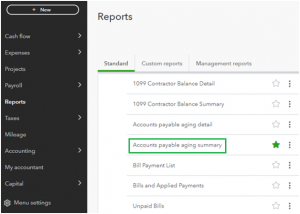

The Means To Prepare Your Ap Getting Older Report

You can learn extra concerning the definition of an aging schedule and its function on-line. For example, a enterprise that strategically delays funds to maximize money readily available without damaging relationships demonstrates savvy monetary administration. Vendor credit score memos are documents that scale back the customer’s stability for returned or broken objects or worth corrections. Clients subtract credit memos from the whole of bill balances due when making funds, or request a refund from the provider when no invoice stability is excellent. Automating AP processes, together with aging reviews, reduces guide workload, improves data accuracy, strengthens audit readiness, and helps financial forecasting.

Whereas the AP getting older report is a straightforward course of, there are several ways groups can enhance the method. CAs, consultants and companies can get GST ready with Clear GST software program & certification course. Our GST Software Program helps CAs, tax specialists & enterprise to handle returns & invoices in an easy method. Our Goods & Services Tax course includes tutorial videos, guides and professional assistance that will assist you in mastering Goods and Companies Tax. Clear can also help you in getting your small business registered for Goods & Providers Tax Legislation. When you pay off an bill, take away the present or past due quantity from your report.

While the details of your accounts payable growing older report may not be equivalent to your competitor’s, the essential construction stays the identical. Many businesses underestimate the importance of accounts payable administration and automation. As the AP course of is significant for each firm, all companies must spend time on its successful implementation. AP automation is very important to increase effectivity and avoid errors made by guide work.

- A detailed AP getting older report reveals invoices with reference quantity, due date, fee terms, and steadiness due.

- The Present column reveals by-vendor totals of the newest invoices with unpaid balances that aren’t yet late for payment.

- If its aging schedule exhibits a rising trend of receivables growing older beyond 60 days, it could must tighten its credit coverage or improve its assortment efforts to avoid liquidity issues.

- Predictive analytics additionally helps determine at-risk accounts earlier than they turn into overdue, allowing you to prioritize collection efforts and focus on the accounts needing essentially the most consideration.

This categorization enables you to rapidly see which invoices need consideration and prioritize your collection efforts. For example, you might see a trend of sure clients consistently paying late within a selected timeframe. This comparative analysis not solely illuminates the liquidity position but also reveals the efficiency of credit score and assortment insurance policies towards payment obligations. By dissecting the aging schedules, stakeholders can discern patterns, determine potential dangers, and strategize for optimal capital allocation. Growing Older schedules are a crucial component in the administration of a company’s funds, particularly in terms of understanding the liquidity and well being of accounts receivable and payable.

These options replace the report in real-time, reflecting any payments or new invoices acquired. The report serves as a software for figuring out discrepancies, similar to duplicate invoices, incorrect quantities, or payments that must be applied correctly. Often reviewing the AP Growing Older Report might help catch these errors early, thus preventing potential monetary discrepancies. In a bustling marketplace, every enterprise proprietor has transactions to track, funds to make, and budgets to handle.

AP automation also provides you higher visibility and management over your financial information. Centralizing the AP process for all the departments with predefined processes will help you to get rid of information redundancy and save time on the purchase bill processing. It may even assist to cut back the info entry errors and control ordering by employees.

Widespread classes embrace current (not but due), 1-30 days overdue, days overdue, days overdue, and over 90 days overdue. These time frames allow you to track cost developments and identify invoices that are turning into more and more tough to collect. The longer an invoice remains unpaid, the higher the risk of it becoming a bad debt. By using these classes, you can proactively address late payments and maintain wholesome money move. Often reviewing your growing older schedule permits you to spot potential problems early and take action https://www.simple-accounting.org/ to mitigate losses.